Reaching Medicare eligibility is a major milestone and finding the right plan is important. We can help you transition carefully from your current employer or individual coverage. We take a very personal approach. This includes guidance on how to apply for Medicare and an education of the government program including Parts A,B,C & D.

Next step, we find your doctors and provide prescription reports based on any medications. These reports include your specific medications, your pharmacy and accurate monthly out of pocket amounts.

![]()

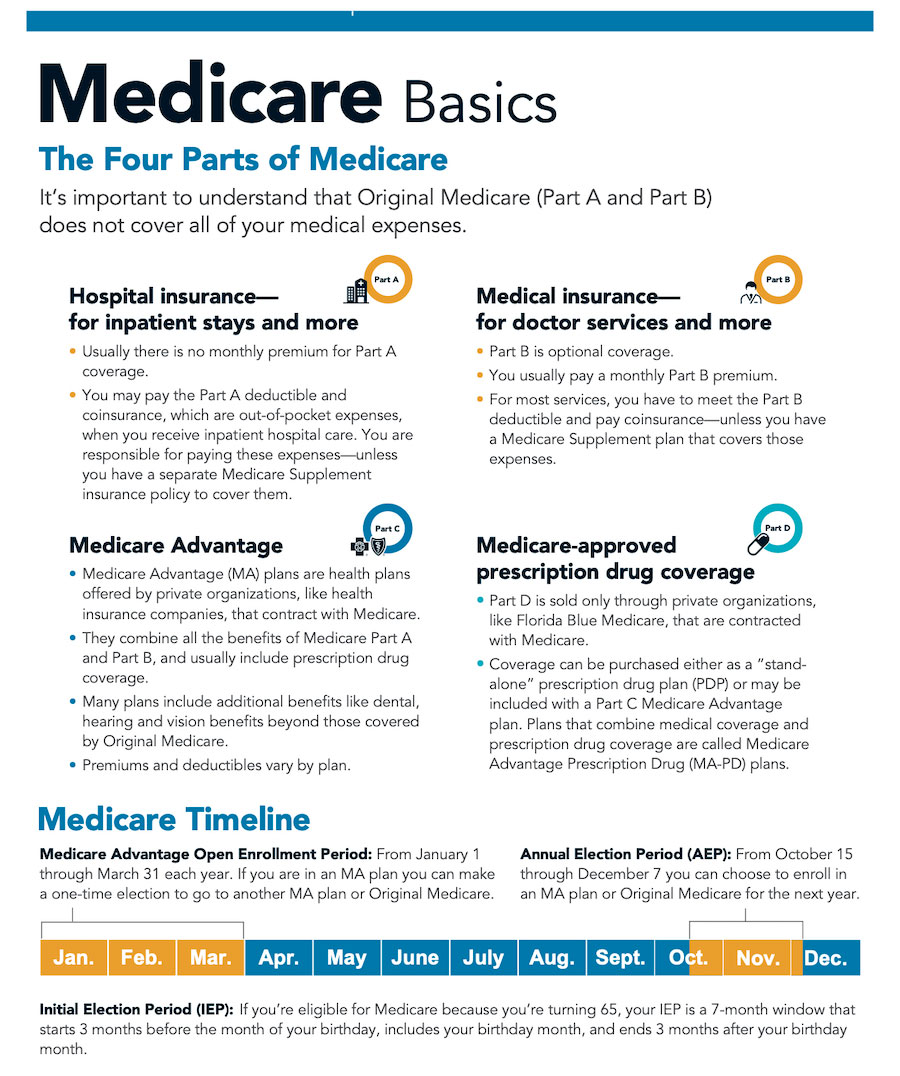

The Four Parts of Medicare

It’s important to understand that Original Medicare (Part A and Part B) does not cover all of your medical expenses

Hospital insurance— Part A Coverage

For inpatient stays and more

- Usually there is no monthly premium for Part A coverage.

- You may pay the Part A deductible and coinsurance, which are out-of-pocket expenses, when you receive inpatient hospital care. You are responsible for paying these expenses—unless you have a separate Medicare Supplement insurance policy to cover them.

Medical insurance— Part B Coverage

For doctor services and more

- Part B is optional coverage.

- You usually pay a monthly Part B premium.

For most services, you have to meet the Part B deductible and pay coinsurance—unless you have a Medicare Supplement plan that covers those expenses.

Medicare Advantage - Part C Coverage

- Medicare Advantage (MA) plans are health plans offered by private organizations, like health insurance companies, that contract with Medicare.

- They combine all the benefits of Medicare Part A and Part B, and usually include prescription drug coverage.

- Many plans include additional benefits like dental, hearing and vision benefits beyond those covered by Original Medicare.

- Premiums and deductibles vary by plan.

Medicare-Approved Prescription Drug Coverage - Part D Coverage

- Part D is sold only through private organizations, like Florida Blue Medicare, that are contracted with Medicare.

- Coverage can be purchased either as a “stand-alone” prescription drug plan (PDP) or may be included with a Part C Medicare Advantage plan. Plans that combine medical coverage and prescription drug coverage are called Medicare Advantage Prescription Drug (MA-PD) plans.

- Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in Original Medicare, like copayments, coinsurance, and deductibles. Generally, you must have Original Medicare—Part A (Hospital Insurance) and Part B (Medical Insurance)—to buy a Medigap policy.

![]()

Medicare Timeline

Medicare Advantage Open Enrollment Period: From January 1 through March 31 each year. If you are in an MA plan you can make a one-time election to go to another MA plan or Original Medicare.

Annual Election Period (AEP): From October 15 through December 7 you can choose to enroll in an MA plan or Original Medicare for the next year.

Initial Election Period (IEP): If you’re eligible for Medicare because you’re turning 65, your IEP is a 7-month window that starts 3 months before the month of your birthday, includes your birthday month, and ends 3 months after your birthday month.

![]()

Resources

- Apply for Medicare Part B Online During a Special Enrollment Period

- Social Security Office Locater

- 2025 Medicare Part B Costs

- Medicare Premiums - Rules for Higher Income Beneficiaries

- Medigap Supplement Guide

- Medicare.gov

- MyPrime.com

Forms